Welcome Here Shenzhen Mingjiada Electronics Co., Ltd.

sales@hkmjd.com

sales@hkmjd.com

Service Telephone:86-755-83294757

Latest Information

Latest Information Home

/Industry Information

/

Home

/Industry Information

/

The automotive embedded connectivity market is expected to reach $5 billion by 2030

On September 23, Counterpoint data showed that in the first half of this year, shipments of automotive connection modules and chipsets only increased by 3% year-on-year. Among them, China is the largest regional market, mainly benefiting from emerging…

On September 23, Counterpoint data showed that in the first half of this year, shipments of automotive connection modules and chipsets only increased by 3% year-on-year. Among them, China is the largest regional market, mainly benefiting from emerging auto brands such as NIO, Xpeng, and Celis, which are increasingly offering infotainment systems with large displays, smart cockpit solutions, as well as those requiring embedded connectivity. ADAS and other functions.

However, in the first half of 2022, China's automotive connectivity module shipments fell by nearly 7% year-on-year due to supply chain disruptions and epidemic containment policies that slowed car manufacturing.

Automakers across Europe are trying to generate significant revenue from subscriptions to in-vehicle software services. To that end, they offer more embedded connectivity features in trims, including lower-end models. The Russian-Ukrainian conflict undermined the post-pandemic recovery of the European auto market, with vehicle connectivity module shipments in the region down more than 10% year-on-year as auto manufacturing in Germany, France, the U.K. and other European countries was affected by parts shortages.

While the two largest markets mentioned above are unavoidably affected by geopolitical factors and pandemic restrictions, North America is still showing more resilience. In 2022, the region's automotive connectivity module shipments will increase by 27% year-on-year.

Counterpoint senior research analyst said that with the increasing adoption of digital functions and ADAS, the demand for embedded connectivity in passenger vehicles will increase.

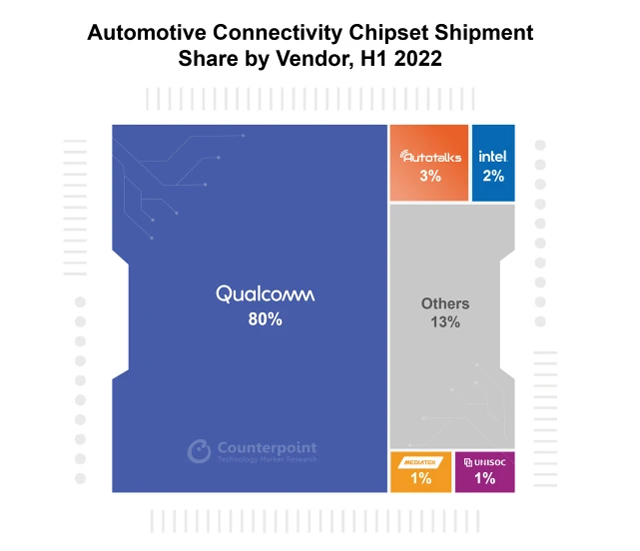

Qualcomm holds more than 80% market share in the automotive connectivity chipset market and provides complete solutions for automotive digital transformation, starting with hardware and extending to cloud services through the Snapdragon Digital Chassis. This one-stop solution can help players in the ecosystem reduce time-to-market and improve competitiveness.

MediaTek and Samsung launched 5G solutions last year. As the automotive industry gradually adopts 5G connectivity, Counterpoint expects MediaTek and Samsung to increase their market share in 5G automotive connectivity. However, they may require a more concerted effort to substantially expand their share and benefit from greater economies of scale.

The vice president of research at Counterpoint predicts that by 2030, shipments of automotive connectivity modules are expected to grow by about 11% annually to 97 million; Half have 5G connectivity. The development of centralized architectures with digital cockpit, autonomous capabilities (ADAS L3+) and electrification will drive the growth of 5G technology penetration. Meanwhile, the automotive connectivity module market is expected to reach $5 billion by 2030. The multi-billion dollar segment opportunity will ensure that the segment remains vibrant and highly competitive.

Time:2025-08-15

Time:2025-08-15

Time:2025-08-15

![[Supply Original] RAA2116514GNP (Renesas) Integrated 60V, 5A Synchronous Buck Regulator](/upload/202508/15/202508151442135784.jpg)

Time:2025-08-15

Contact Number:86-755-83294757

Enterprise QQ:1668527835/ 2850151598/ 2850151584/ 2850151585

Business Hours:9:00-18:00

E-mail:sales@hkmjd.com

Company Address:Room1239, Guoli building, Zhenzhong Road, Futian District, Shenzhen, Guangdong

CopyRight ©2022 Copyright belongs to Mingjiada Yue ICP Bei No. 05062024-12

Official QR Code

Links: