Welcome Here Shenzhen Mingjiada Electronics Co., Ltd.

sales@hkmjd.com

sales@hkmjd.com

Service Telephone:86-755-83294757

Latest Information

Latest Information Home

/Industry Information

/

Home

/Industry Information

/

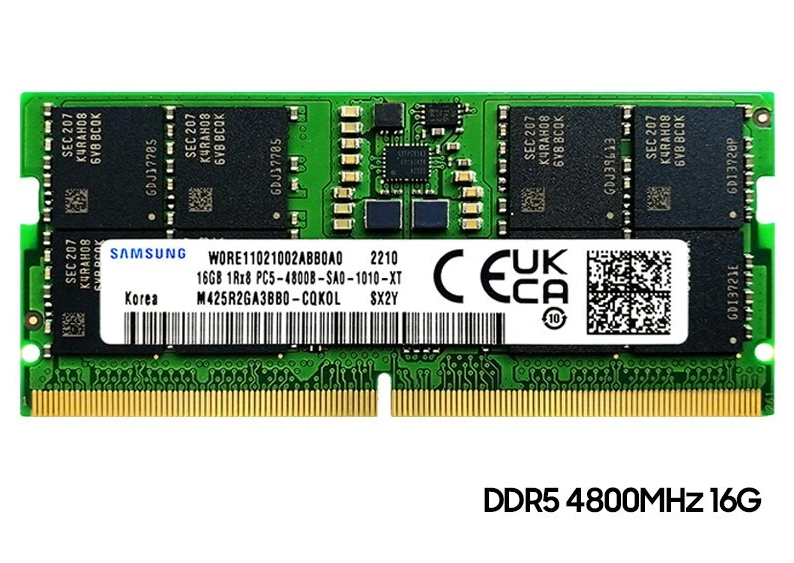

Samsung has no plans to significantly adjust supply or reduce production in the short term

March 13 - The situation in the memory semiconductor market deteriorated more than expected in the first quarter of this year, with inventory levels once reaching dangerous levels, but Samsung Electronics is already preparing for a long-term battle in…

March 13 - The situation in the memory semiconductor market deteriorated more than expected in the first quarter of this year, with inventory levels once reaching dangerous levels, but Samsung Electronics is already preparing for a long-term battle internally.

Available sources indicate that Samsung Electronics, as well as SK Hynix, both companies appear to be more focused on a 5 to 10 year cycle rather than short-term extreme supply control due to the possibility of negative growth in the memory semiconductor market this year.

According to a source familiar with Samsung Electronics, "Samsung Electronics has no plans to significantly adjust supply or reduce production in the short term," the Chosun Ilbo reported today, explaining that most internal references are for single-digit market demand growth over a 5 to 10 year period.

According to the source, the natural reduction in production due to production line repositioning, process conversions, etc., is the highest level of supply adjustment that can be made at this time.

Samsung Electronics has maintained its "no artificial production cuts" stance despite announcements by its competitors SK Hynix and Micron to reduce investment and production. This was reflected in Lee Jae-yong's recent statement, "Despite the difficult situation, we must not waver in our efforts to nurture talent and invest in future technologies."

In the first quarter of this year, inventory levels have been rising due to delays in memory pulls caused by inventory buildup at major customers, and SK Securities predicts that Samsung Electronics' inventory value will increase to more than 13 weeks in the first quarter of this year, and to around 15 weeks by the end of the quarter. This figure is four times the normal level. Analysts point to an increase to 20 weeks in the second quarter, with inventories building up for five to six months.

According to TrendForce, global DRAM sales in the fourth quarter of last year fell 32.5% from the previous quarter to US$12.281 billion (IT House note: currently about RMB85.23 billion), close to the decline in sales in the fourth quarter of 2008, when the global financial crisis hit (36%), but Samsung Electronics' market share rose from 40.7% to However, Samsung Electronics' market share rose from 40.7% to 45.1%, an increase of 4.4 percentage points.

Time:2025-08-16

Time:2025-08-16

Time:2025-08-16

Time:2025-08-16

Contact Number:86-755-83294757

Enterprise QQ:1668527835/ 2850151598/ 2850151584/ 2850151585

Business Hours:9:00-18:00

E-mail:sales@hkmjd.com

Company Address:Room1239, Guoli building, Zhenzhong Road, Futian District, Shenzhen, Guangdong

CopyRight ©2022 Copyright belongs to Mingjiada Yue ICP Bei No. 05062024-12

Official QR Code

Links: