Welcome Here Shenzhen Mingjiada Electronics Co., Ltd.

sales@hkmjd.com

sales@hkmjd.com

Service Telephone:86-755-83294757

Latest Information

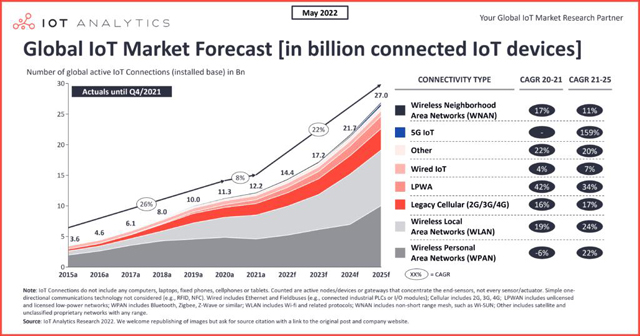

Latest InformationBy 2022, the IoT market is expected to grow by 18% to 14.4 billion active connections. By 2025, as supply constraints ease and growth further accelerates, there will be approximately 27 billion connected IoT devices.

Chip shortages continue to slow the Internet of Things (IoT) market recovery, according to our latest Spring 2022 State of the Internet of Things report. In 2021, the number of global IoT connections will grow by 8% to 12.2 billion active endpoints, a significantly lower increase than in previous years.

IoT Market Forecast

Despite strong demand for IoT solutions and positive sentiment in the IoT community as well as in most IoT end markets, IoT Analytics expects the impact of chip shortages on the number of connected IoT devices to continue beyond 2023. Other headwinds for the IoT market include the ongoing COVID-19 pandemic and general supply chain disruptions. By 2022, the IoT market is expected to grow by 18% to reach 14.4 billion active connections. By 2025, as supply constraints ease and growth further accelerates, there will be approximately 27 billion connected IoT devices.

Both the 2021 actual and current 2025 forecast for IoT devices are lower than previous estimates. (The previous estimate for 2021 was 12.3 billion connected IoT devices; the previous forecast for 2025 was 27.1 billion connected IoT devices). Let’s take a look at how IoT connectivity will be impacted in 2021, where we are in 2022 and where we might be heading beyond 2022.

IoT in 2021: Selected Growth Highlights

Here are some key trends that will impact the growth in the number of connected IoT devices in 2021:

1. LPWA networks expand, especially those using NB-IoT technology: NB-IoT adoption (eventually) took off, with 61% year-over-year growth in connections thanks to various implementations, especially in water and gas metering field.

2. Users are moving from traditional 2G/3G to 4G/5G IoT: 4G IoT connections grew by 24% due to higher adoption of LTE Cat 1, Cat 4 and Cat 6 based chipsets. For many implementations, LTE Cat 1 bis is emerging as an alternative to the LPWA technologies mentioned above.

3. Chip shortages continue to slow market recovery: see above.

4. COVID-19 Continues to Impact Products and Supply Chains: In 2021, ongoing (local) COVID-19 restrictions have resulted in many new and severe supply chain issues, such as lack of ships, trucks and containers, and port congestion.

The State of IoT in 2022

Despite a pullback from the highs in the fourth quarter of 2021, the current business sentiment for digital and IoT companies remains largely positive. It is widely acknowledged that COVID-19 has had an overall positive impact on the accelerated adoption of IoT technologies. This is confirmed by sentiment analysis of IoT vendor CEOs' quotes and earnings calls. Companies offering connectivity services (sentiment score of 117), general software (115), cybersecurity (113) and cloud (113) had the highest sentiment.

"[During the first quarter of 2022], we saw strong demand again from our end markets. Overall, we continue to forecast favorable demand conditions for the second half of the year," Avnet CEO April 27, 2022 express.

"As more companies gather business-critical data from the network edge, we see continued momentum in key IoT markets including industrial, enterprise, energy and first responders. May 12, 2022 Sierra Wireless Chief Executive Officer Executive Phil Brace said the COVID-19 pandemic has accelerated Industry 4.0.

Regionally, North America market sentiment leads (116) and Asia Pacific (103) lags, especially in China, where new COVID-19 lockdowns are seen as a major threat to business growth in the region.

IoT beyond 2022: key macro themes

While the state of IoT in 2022 is critical, our research isn't just this year. In our latest research, we highlight and discuss eight key macro themes of concern, many of which are interconnected. Here is a sample selection:

1. Inflation: Global growth forecasts are declining as inflation rises above 5% per year. Expectations for higher interest rates and subsequent economic cooling have been raised in most of the world's major economies.

2. Ongoing war in Ukraine: The war in Ukraine exacerbates supply disruptions and inflation problems. For example, Rajeev Chandrasekhar, India’s Minister of State for Electronics and Information Technology, said: “The conflict between Russia and Ukraine has affected the supply chains of numerous industries, including the semiconductor industry. The conflict may have a particular impact on the supply of neon and hexafluorobutadiene gases. , these gases are essential elements in the manufacture of semiconductor chips, as they are used in the lithography process for chip production."

3. The battle for digital talent: Many companies face enormous challenges in finding the skilled workforce to fully advance digital transformation, AI, IoT and cloud projects. IoT Analytics keeps track of online job advertisements. From July 2021 to April 2022, the number of job advertisements containing "Internet of Things" increased by +32%. Including "artificial intelligence" (+48%), "edge computing" (+53%) and "5G" (+52%) demand is even higher.

Due to some of these macro factors, notably inflation, companies are forced to focus more on operational efficiency to offset cost pressures and secure supply to customers.

Other IoT Research Highlights

There are a few other noteworthy research highlights on IoT:

Record level of VC investment in IoT companies: According to our research, global VC investment in IoT companies increased to a record $1.2 billion in Q1 2022, compared to just $266 million in Q1 2021, deals Reduced total, but very large number of funding rounds. Recent investments have focused on artificial intelligence and analytics, cybersecurity and IoT connectivity.

Several large IoT-focused acquisitions: Between Q3 2021 and Q1 2022, IoT companies focused on AI and analytics, IoT software, and semiconductors/chips combined accounted for approximately 45% of related major acquisitions. Many of these deals are by acquirers looking to create a more complete technology stack or product portfolio and reduce external dependencies.

IoT is growing rapidly

Growth in the number of connected devices slowed in 2021, but is expected to re-accelerate in 2022 and beyond. The current state of IoT in 2022 brings new headwinds such as inflation and chronic supply disruptions, and overall sentiment continues to be relatively optimistic, with the number of connected IoT devices expected to reach 14.4 billion by the end of 2022.

Time:2025-09-06

Time:2025-09-06

Time:2025-09-06

Time:2025-09-06

Contact Number:86-755-83294757

Enterprise QQ:1668527835/ 2850151598/ 2850151584/ 2850151585

Business Hours:9:00-18:00

E-mail:sales@hkmjd.com

Company Address:Room1239, Guoli building, Zhenzhong Road, Futian District, Shenzhen, Guangdong

CopyRight ©2022 Copyright belongs to Mingjiada Yue ICP Bei No. 05062024-12

Official QR Code

Links: