Welcome Here Shenzhen Mingjiada Electronics Co., Ltd.

sales@hkmjd.com

sales@hkmjd.com

Service Telephone:86-755-83294757

Latest Information

Latest Information Home

/Industry Information

/

Home

/Industry Information

/

ADAS and AD chip market prospects are promising, SoC manufacturers are laying out automatic driving

Recently, according to the financial report data for the second quarter of 2022 released by chip suppliers such as ST and NXP, benefiting from the high demand for automotive chips, market revenue still maintained an astonishing growth rate of 28%. For…

Recently, according to the financial report data for the second quarter of 2022 released by chip suppliers such as ST and NXP, benefiting from the high demand for automotive chips, market revenue still maintained an astonishing growth rate of 28%. For the automotive chip market trend, major manufacturers are still optimistic about the future prospects. Especially in the new market of autonomous driving SoC, NVIDIA, Qualcomm, NXP, Horizon and others have invested heavily.

In the autonomous driving SoC industry, the market is gradually consolidating into some very large players and driving the development of the ADAS chip market. Market institutions predict that by 2024, the penetration rate of ADAS in global vehicle shipments will reach 78.7%. Combined with higher safety standards and lower component prices, the revenue market share of the Tier 2 category will reach 44.4% in 2022 and 60% in 2024.

L4-level SoCs are expected to account for 24% of revenue by 2030. These SoCs will be used in premium cars and AI taxis as they have higher barriers to entry and cost higher than L3 level SoCs.

With the continuous development of electrification and intelligence, semiconductors are becoming more and more important for automobiles. Among them, the level of intelligence has become an important factor for customers to consider when purchasing vehicles. The accuracy and efficiency of autonomous driving depend on the computing power and manufacturing process of the chip.

Therefore, the increasing demand for autonomous driving is driving the demand for advanced processes for automotive chips and will significantly increase the market size of advanced driver assistance systems (ADAS)/autonomous driving (AD) chips. The computing power of the ADAS/AD processor must meet the requirements of the corresponding autonomous driving level.

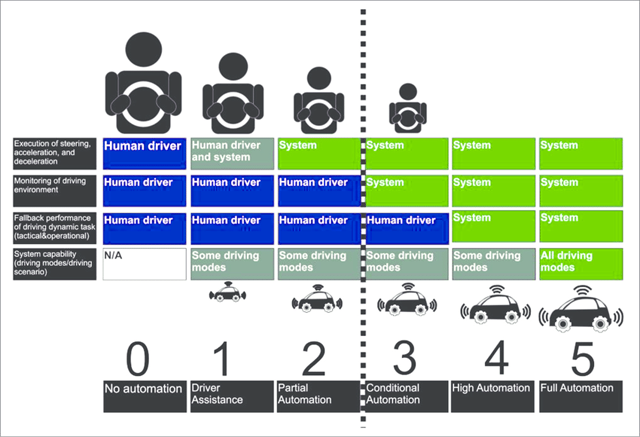

According to the definition standards of the Society of Automotive Engineers (SAE) for various levels of autonomous driving, the TOPS (trillion operations per second) of L2-level ADAS/AD chips is usually between 10 and 100, and the TOPS of L3-level is between 150 and 200. , the TOPS of L4/5 level exceeds 400 and will reach 1000+. Each level is further divided based on functionality.

Base Level 2 features only include Adaptive Cruise Control (ACC) and Lane Keeping System (LKS), and are available via an SoC with just 10 TOPS. However, advanced level L2 may require up to 75 TOPS to achieve advanced ACC.

The global ADAS/AD SoC market is expected to reach $30 billion by 2030, with a CAGR of 26.3% from 2022 to 2027. The revenue market share of L2-level SoCs will reach 44.4% in 2022, and this share will reach an all-time high of 60% in 2024 due to upgraded safety standards and lower component prices. It will take a few years for L3 AD systems to gain public trust, but by 2027 they will replace L2 as the standard.

Compared with L3-level SoCs, L4-level SoCs have greater computing power and bandwidth, and can process more high-resolution images and respond quickly. Therefore, the entry barriers and cost of L4-level SoCs are much higher than L3-level SoCs, so they will be mainly used in luxury cars and AI taxis.

Low barriers to entry for L1 and L2 ADAS SoCs. Thus, while the cost of ADAS sensors, such as cameras and radar, continues to decline, ADAS penetration can increase significantly. Counterpoint expects global penetration of ADAS in automotive shipments to reach 78.7% by 2024.

At the same time, multiple new players will enter the ADAS chip market. These startups are capable of AI chip design and mass production, and their solutions can quickly meet localization requirements, such as local languages and localization algorithms, at competitive prices.

As a result, emerging automotive OEMs will favor these new solutions. However, traditional automotive chips, such as Renesas and NXP, are also offering solutions. The L3 level uses more sensors and more efficient computing units than the L2 level. The most notable difference between Level 3 and Level 4 is the improvement in artificial intelligence, as Level 4 autonomous vehicles must be able to make quick decisions.

On the other hand, the development of autonomous driving (AD) chips has been largely driven by established consumer electronics giants such as NVIDIA and Intel (Mobileye). The R&D expenditure and entry barriers of AD chips are significantly higher than ADAS. In addition to the core AI chip, AD solutions should include connectivity, sensing systems, image training models, ADAS map development, route planning, vehicle control, driver monitoring systems (DMS), natural language processing (NLP), and intelligent driving cabin solution.

In addition, AD chips must be able to provide customized and region-specific algorithms. This has to be done through a partnership between automotive OEMs and AD chip companies.

Time:2025-09-06

Time:2025-09-06

Time:2025-09-06

Time:2025-09-06

Contact Number:86-755-83294757

Enterprise QQ:1668527835/ 2850151598/ 2850151584/ 2850151585

Business Hours:9:00-18:00

E-mail:sales@hkmjd.com

Company Address:Room1239, Guoli building, Zhenzhong Road, Futian District, Shenzhen, Guangdong

CopyRight ©2022 Copyright belongs to Mingjiada Yue ICP Bei No. 05062024-12

Official QR Code

Links: