Welcome Here Shenzhen Mingjiada Electronics Co., Ltd.

sales@hkmjd.com

sales@hkmjd.com

Service Telephone:86-755-83294757

Latest Information

Latest Information Home

/Industry Information

/

Home

/Industry Information

/

Storage Chip Market On Fire! The Reason Behind The 50% Surge In Prices?

The global storage chip market is ushering in a new wave of price increases. Following SanDisks announcement of a 10% price increase from April, major storage chip makers such as Micron, Samsung Electronics, SK Hynix, and Cheung Kong Storage are also …

The global storage chip market is ushering in a new wave of price increases. Following SanDisk's announcement of a 10% price increase from April, major storage chip makers such as Micron, Samsung Electronics, SK Hynix, and Cheung Kong Storage are also planning to raise prices from April. Behind this wave of price increases is the result of a combination of production cuts by major storage manufacturers, ‘black swan events’ and strong growth in the demand side of AI.

Tightening supply drives prices up

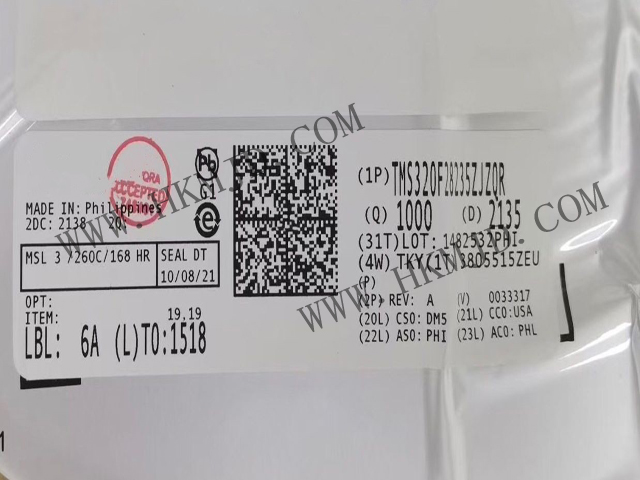

Since Q4 2024, the five major NAND OEMs - Samsung, SK Hynix, Micron, Western Digital and Armor Man - have taken production cuts in response to the market's oversupply. The effect of the production cuts began to show in the first quarter of 2025, and the tightening supply became one of the main factors driving up prices.

In addition, Micron's Singapore NAND plant had a power outage in January, leading to production disruptions that further exacerbated the supply shortage. Although Micron has yet to publicly respond to the matter, it announced an 11 per cent increase in the average price of new orders in early March, showing the impact of tightening supply. Pan Jiancheng, chairman of Qunlian Electronics, revealed that despite orders having been placed in December 2024, Micron has recently experienced delivery shortages, leading to delays in the delivery of some orders.

Samsung and SK Hynix are also planning to raise prices from April in response to market trends. Both companies have already cut production significantly, resulting in a more than 10 per cent drop in output in the first quarter compared to the end of 2024. Samsung's deliveries in March were only 20-25 per cent of original orders, while manufacturers such as SK Hynix are facing a similar situation. This tight supply situation has directly provided strong support for price increases. Normal deliveries are expected to resume after April, and NAND prices are expected to rise by about 10 per cent or more.

Domestic storage chip companies have also begun to follow suit. On Friday, a channel feedback Changjiang storage retail brand to state will also be in April for the channel to raise the price of goods, the range will be more than 10%. Industry insiders pointed out that this year's storage chip market price increases are mainly concentrated in the field of 3D NAND, overseas original factory and Changjiang storage is the main beneficiary. The domestic 2D NAND market has maintained stable prices due to mature technology and sufficient supply.

CFM flash memory market pointed out that with the original factory price hike to make most of the resources in short supply, channel manufacturers generally follow the pace of the original factory to further increase, of which, the channel SATA SSD rose the strongest, in the price increase atmosphere under the auspices of the warming of the sentiment of buying up the spot enquiry increased greatly, some products appear panic stocking demand. Overall, the channel customers are mainly appropriate stocking, but also due to the higher price increases, some customers are in a ‘want to buy’ predicament. In addition, due to some resources out of stock, and channel manufacturers delivery date in April and May, if the subsequent original factory still continue to control the supply of goods, part of the channel manufacturers are afraid to face the risk of difficult to ensure delivery.

It is worth noting that, with the resource side of the continued price increases, so that the channel part of the finished product is facing the pressure of the inversion of the intensification, which makes part of the channel storage prices quickly pushed up.

Affected by some material number production stoppage, part of the resource supply is tight and rapid price increases, so that MLC NAND and other small-capacity eMMC finished product prices climbed rapidly, and from the turnover point of view, some end customers have already accepted the price increase, and are completing the transaction one after another. At the same time, large-capacity eMMC, UFS 2.2, and LPDDR4X have also increased across the board due to rising costs.

Some industry insiders pointed out that compared with the end of 2024, the price of some eMMC 32GB products in the spot market has risen by more than 30 per cent, and it is expected that the rate of increase will further expand to 50 per cent in April.

Demand is picking up, supply is tightening, and the overall significant oversupply in the storage industry is improving. ‘There are already clear signals of stopping the decline in the spot market,’ said Tai Wei, General Manager of Flash Memory Market at CFM, ’We expect that in the Q2 quarter, the prices of some NAND products in particular will be the first to start stabilising, and there will be an opportunity for an overall rebound in Q3.’

Qunlian CEO Pan Jiancheng predicted that the first quarter of 2025 will be the low point of NAND prices for the year, and the tight supply and demand in the second half of the year will drive prices to ‘jump up quarter by quarter’ TrendForce expects that the cumulative increase in NAND Flash prices during the year may exceed 50%, and DRAM prices will enter a ‘staircase rise’. DRAM prices will also enter a ‘staircase rising channel’.

AI push storage demand outbreak

In addition to the original factory to control the production, AI demand is also one of the reasons to promote the price increase of NAND Flash.

With the rapid development of AI technology, the explosive growth of arithmetic is driving the rapid increase in storage demand, and the era of high-capacity storage has arrived in advance. From AI mobile phones, AI PCs to AI servers, the demand for storage capacity is showing exponential growth, and advanced storage technologies such as QLC flash technology and high-bandwidth memory (HBM) are rapidly becoming the focus of the market.

In terms of applications, the server market has become the core driver for the development of storage demand. in 2024, the capacity of server NAND surged by 108%, while server DRAM and HBM grew by 24% and 311%, respectively. According to CFM flash market data, the number of server units will continue to grow to 13.3 million units in 2025, with AI servers accounting for 14% of the total, further pushing up server storage configurations.

The popularity of AI technology has led to a significant increase in the demand for storage capacity in end devices such as AI mobile phones and AI PCs. For example, the average DRAM capacity of AI mobile phones has increased from 8GB to 12-16GB, while the DRAM capacity of AI PCs has jumped from 12GB to 16-64GB.Meanwhile, the NOR flash capacity of wearable devices such as AI headsets has also increased from 64-128Mb to 256Mb.

Micron expects 43 per cent of PCs to be AI-capable in 2025, with that percentage rising to 64 per cent by 2028. Future AI PCs will require 80% more memory capacity than current PCs. Smartphones, which serve as a gateway for people to connect to the digital world, will drive greater market growth when equipped with AI capabilities. The agency forecasts a 73.1 per cent year-on-year growth in the AI mobile phone market in 2025, with 50-100 per cent year-on-year growth in LPDDR5X memory capacity carried in flagships.

Industry insiders said, ‘32TB SSDs in enterprise-level applications have been mass-produced, and the demand for 64TB and 128TB is also increasing. the popularity of AI mobile phones and AI PCs will further promote the storage capacity configuration of end products, greatly consuming storage capacity. In addition, the demand for data storage in emerging fields such as smart cars and the Internet of Things is also increasing, and AI PCs, smart cars, and other devices equipped with AI functions have become a new engine of growth in storage chip demand.’

With the popularity of AI technology and the increase in arithmetic power, storage demand is experiencing unprecedented growth. The rapid development of servers, AI mobile phones, AI PCs, smart cars, and other fields has driven the innovation and application of high-capacity storage technology. Storage vendors have accelerated their layout and introduced high-performance, high-capacity storage solutions to meet the data storage needs of the future AI era.

Time:2025-08-18

Time:2025-08-18

Time:2025-08-18

Time:2025-08-18

Contact Number:86-755-83294757

Enterprise QQ:1668527835/ 2850151598/ 2850151584/ 2850151585

Business Hours:9:00-18:00

E-mail:sales@hkmjd.com

Company Address:Room1239, Guoli building, Zhenzhong Road, Futian District, Shenzhen, Guangdong

CopyRight ©2022 Copyright belongs to Mingjiada Yue ICP Bei No. 05062024-12

Official QR Code

Links: